Have you finally gone back to get a drink with a friend in an open-air bar? Have you gotten that much needed haircut? Although the Pandemic isn’t over, there is some ounce of normalcy that has returned. You’ve started going outside, started extending your “COVID-bubbles”, and have learned how to live in a world with a virus. How do I know what you’re doing? Because I am watching you..

I’m playin..

Economy Pulse Check

I know because consumer spending is back up! At least 3/4 of the spending that was subdued during the lock-down is back. We can attribute this to pent-up demand from the months that we were locked-in. The labor market is slowly creeping back in but has reflected unemployment hovering around 8%, which is not great but is much better than the near-15% unemployment in May. However, we are not at all near pre-pandemic levels of growth. Industries that still require gathering large amounts of people are still down: namely, travel, hospitality, and entertainment (Although that is evolving rapidly).

“Weaker demand and significantly lower oil prices are holding down consumer price inflation. Overall financial conditions have improved in recent months, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses. “ - Jerome Powell

Federal Reserve Responsibility Review

Maintain Price Stability (Control Inflation)

Maximum Employment

As the Economy starts getting back on its feet, there is an expectation from the financial community (Banks and other Financial Institutions) to experience the tightening of monetary policy. This generally means that as inflation approaches 2%, the financial community expects the federal reserve to raise interest rates to eventually slow down consumer spending and percievably ‘control’ inflation.

Learn about how the fed raises and lowers interest rates

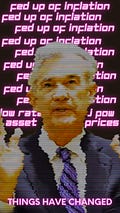

This time it’s different…

Beyond 2 % - Flexible Average Inflation Rate Targeting

Recently, Jerome Powell announced a ‘new’ approach to what the federal reserve will do in light of this new ‘recovery’. Instead of tightening monetary policy, the fed intends to ‘Let the economy run hot’, which means that as we get closer to 2% inflation, the fed will not commit to rate hikes.

A technical note on Flexible Average Inflation Rate Targeting

We’re gonna have low interest rates for a very long time. Debt will remain cheap, and we are going to see the the announcements of the federal reserve become less relevant to investors.

‘Powells laid down the law.. “ - Jim Cramer

Jim Cramer was extremely pleased

The idea of the “New normal” of the federal reserve started before Jerome Powell, took the stage, in 2012. Rates were nearer to the lower-bound for the past decade. We’ve had cheap money! Lower rates often lead to cheap debt.

If you remember what happened earlier in the year, the Fed had lowered the interest rate to near-zero. Along with that, the fed used a range of monetary policy tools (Even a Main Street Lending Program, that hasn’t been activated since the 1930’s).

The Inclusion Play

With the new ‘hands-off’ approach that the Federal Reserve is taking, there is also some positive news for the low to middle-income Americans that have historically been left out of the cheap debt cycles.

During recessions, the low-income, underrepresented populations are usually the slowest to recover. By the time that they’ve recovered, the Fed has already started hiking rates. Jerome Powell made it a point to inform us that this time, they’re going to wait until even the low-income Americans are going to experience the boost in credit.

However, that begs the question: does that cause inequality to worsen? With the rich already getting richer at a ‘fractal’ rate, we might see cheap money get further utilized by the elites through this 0% interest rate environment..

Cheers..