Discover more from Your Dose of THC

Political polarization is at its highest peak today with governments turning increasingly nationalistic and enacting protectionist policies. World trade is a tricky story nowadays with the threat of a different type of globalization, one with much more trade wars. The population is questioning authority, displayed by the protests all over the world on governments that have failed the people. We have Hong Kong, where the new extradition law, seen to be a push from the Chinese government, brought millions of people to the streets. We have Lebanon, where the people have had enough of government corruption and the lack of social services. Indonesia, where the new criminal code for sex outside of marriage including living together without being married is making people angry (It makes me angry just writing this). Netherlands and France with their agricultural protests unhappy with the taxes and policy. Peru, Haiti, and Venezuela are struggling with leadership. The world is messy, and the people grow weary of government performance. Governments around the world are dealing with the questions on distribution, social welfare, and inequality.

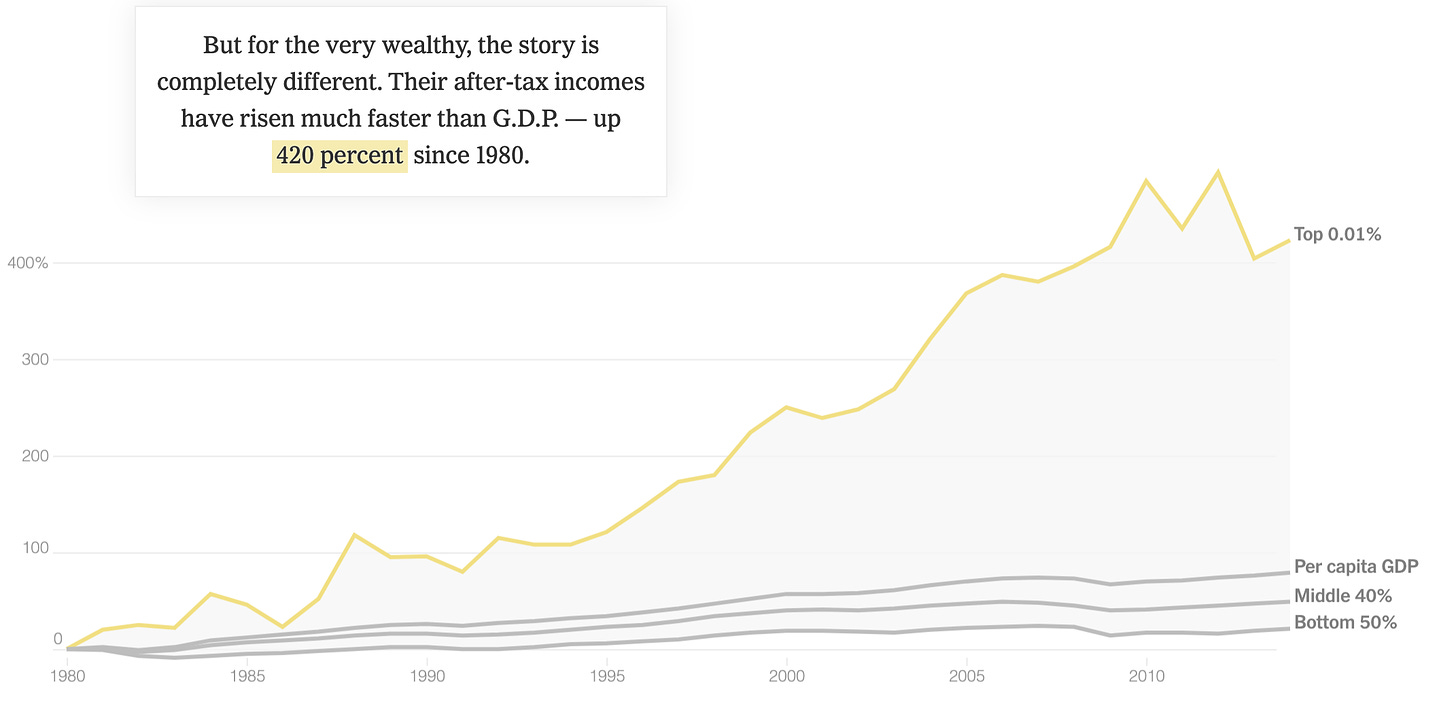

Source - The New York Times

As I think about the future that my children will eventually live in, I am horrified. It seems that most parts of the world haven’t figured out the optimal mix between innovation of social equality. Maybe the Nordic countries have come close, but the world is large, and the application of the same tools or policies may be troubling given the differences of situations. There is no one solution to get a fairer picture of inequality, where the top 10% doesn’t own 50% of wealth, where no one fears government abandonment, where everyone can at least be guaranteed a warm meal and the joys of a healthy economy. However, how shall we conclude how to look at this problem? Thomas Piketty, a French economist, may have a few answers.

“Capital of the 21st Century”, Piketty’s book highlights the change of Capitals role and the problem of inequality in both income and wealth. The main thesis is pretty simple math:

r = rate of return of capital

g = rate of economic growth

In the long term, when the rate of return of capital (r) is greater than the rate of economic growth (g), the outcome is the concentration of wealth to a smaller denomination of the economy.

In other words, this is the explanation to his projection of increasing inequality in the long term, given the data that we have today about having much more average rates of return on capital vs the rate of economic growth. If there is a global slow-down on economic growth (GDP growth), then capital will consolidate at the hands of the wealthy. He argues that throughout economic history, the 18th and 19th centuries, Europe has been highly unequal. The 2 world wars and the depression were the only events that disrupted this trend because of the destruction of capital stock. In the book he also offers a radical remedy to the ever-rising inequality:

Global Wealth Tax (80% on incomes above $500,000 a year) - He acknowledges this is politically impossible

“Confiscatory” global tax on inherited wealth (Similar to inheritance tax in France but more extreme)

It is widely criticized by economists from different political spectra, but the contribution to data and economic history is agreed to be vital. The host of criticism I have been seeing in the news is not backed by a lot of solutions rather answers to why all this is just wrong and impossible.

Personally, I think the biggest value of this book beyond the data that it provides economists to use for decision-making, is the attention that it puts to inequality. Wealth inequality, greater than income inequality is causing the concentration to rob the rest of the economy of a healthy lifestyle. There is more empowerment to question the policy on wealth transfers and wealth generations. Piketty fails to acknowledge the wealth transfers into his models of inequality but nonetheless helpful to think about how we should see inequality.

Are we doing enough?

Are there enough economists working on policies to help curb this phenomenon that might help my children to work in more ‘fair’ environments where the middle class grows again, millennials aren’t strapped with debt the moment they leave college, wealth creation becomes easier, and everyone is on a level-playing field to change the world.

℗ & © 2020 Things Have Changed

Subscribe to Your Dose of THC

Unpacking the Change taking place in our Economy